Hacking healthcare: HSAs and FSAs

Often underutilized and misunderstood, HSAs and FSAs may be changing the game for preventative healthcare.

Navigating the healthcare system can be extremely complicated and overwhelming, especially as about 4 million workers switch jobs on average each month. Most people are insured through their employer with more than 50% on an employee sponsored plan. There are numerous types of plans and increasingly high deductibles that can be difficult to navigate. Many are eligible for Health Savings and Flexible Spending Accounts, but don’t even know it. HSAs and FSAs are types of accounts that allow individuals to set aside money for qualified medical expenses. Qualified medical expenses may include deductibles, co-payments, prescriptions, OTC medications, and even various preventative healthcare tools.

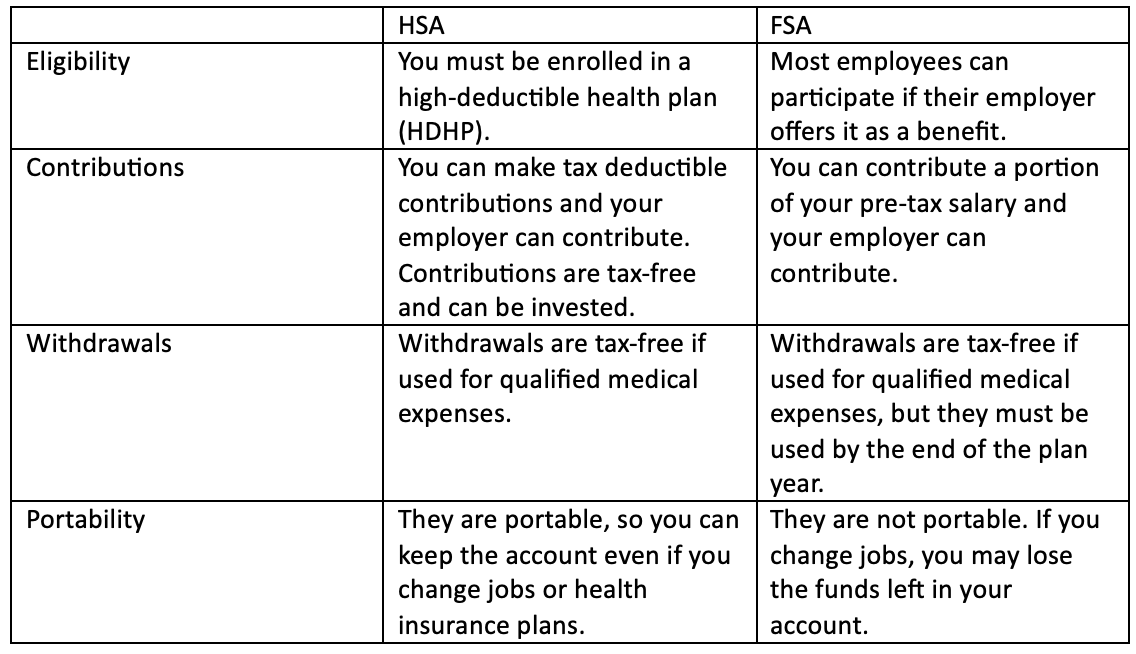

Here is a high-level breakdown of the differences:

Often employees are offered a selection of a few health insurance plans when they join a new company and are given little to no direction on which plan is the right fit for their health history and needs. The complexity and lack of transparency coupled higher rates of employee turnover, make optimizing health insurance daunting for most consumers and leave HSA/FSA accounts extremely underutilized. HSA and FSA benefits may vary slightly but can be a super useful took to help individuals and families manage their healthcare expenses. Most individuals are not aware of the wide range of uses for HSA and FSA accounts.

Something that is relatively new to the HSA/FSA space and is a huge driver of value for consumers is an increased health and wellness offering. There is over $150B in Americans HSA/FSA accounts but a majority of the funds are being used to address illness and pay for medical emergencies. As society shifts away from the sick care model and more consumers are exploring holistic and natural health solutions, offering tax-free spending on preventative products and services can be a game changer especially for the average healthy patient. The definition of qualified medical expenses has been expanded to include gym memberships, exercise equipment, and fitness classes, nutritional supplements and specialized diets, such as meal prep and delivery services, mental health and stress reduction resources, preventative care and screenings, such as diagnostic tools and scans, alternative therapies such as acupuncture and chiropractic care, and more.

Access to these health and wellness products is being democratized through platforms such as the HSA and FSA Stores and start up TrueMed, co-founded by leading voice in food and nutrition Calley Means. TrueMed is a healthcare payment integration system that allows consumers to purchase health and wellness products through their HSA/FSA accounts.

Many of TXV’s own portfolio companies are now included as HSA/FSA qualified medical expenses. Oura announced reimbursement through HSAs/FSAs in late 2023. Shortly after, Future, a personalized training app, announced they would now be covered. Sleep and physical fitness are fundamental to health and have a profound impact on an individual’s likelihood to develop costly chronic diseases later in life. The list of covered preventative health expenses has continued to expand quite rapidly in recent years. Prenuvo’s famous full body scans, notable amongst Hollywood’s A-listers, is now HSA/FSA eligible. By allowing consumers to use their HSA/FSA dollars towards preventative holistic health options, we can reduce poor long-term health outcomes and reduce the cost from serious illness and disease in the future to our healthcare system.

Although we are likely many years away from traditional insurance coverage for consumer health and wellness solutions, new coverage through HSA and FSA accounts indicates a broader shift in the future of healthcare. As we approach this next phase, there is bound to be a focus on prevention versus treatment as providers continue to transition to value-based care plans in the attempt to improve health outcomes. Ultimately, if you are already spending on health and wellness, it may be time to look into funding an HSA or FSA account.

Do you think that preventative healthcare is the next phase of the market? Will preventative products and services ever be covered under traditional insurance? Would love to hear your thoughts in the comments below.